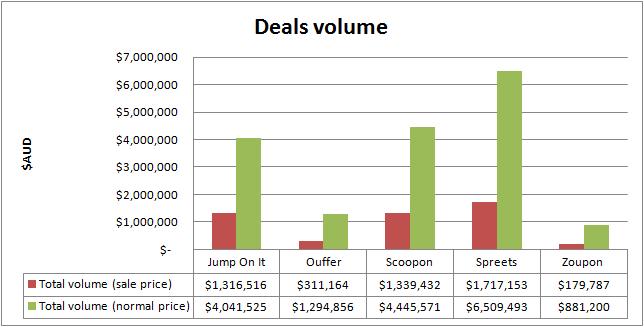

Recent research conducted by Professor Utpal M. Dholakia from Rice University contains facts that are not very pleasant form currently booming group buying industry:

- just a bit more than half (55.5%) of businesses recorded a profit after group buying promotion, more than quarter (26.5%) made losses and the rest broke even

- less than half of businesses that ran group buying promotion are going to do it in the future;

- almost 3/4 of merchants have no loyalty to group deal provider and ready to switch

So the conclusion that the researchers made is not very positive for group buying industry especially for websites that provide deals: the little loyalty, low rate of interest to repeat purchase from merchants and increasing competition will lead to the erosion of the current healthy margin and make the life of group deals providers harder.

The research collected data from 324 US businesses operating in 23 markets that used group buying promotion in 2009-2011.

Continue reading “Group buying industry future looks not so cloudless”